25+ Mortgage borrowing amount

Specialty Mortgage Brokers for Florida Texas California. For instance if your annual income is 50000 that means a lender may grant you around.

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

The cost of your mortgage depends on several factors including how much youre borrowing your mortgage term and the rate of interest youre paying.

. Email the 12000000 Mortgage. HSBC now requires borrowers who apply for a mortgage at. Simply enter your total household income below and our calculator will do the.

Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria. Two of the UKs biggest mortgage lenders have tightened their criteria for applicants looking to take out larger loans.

Use the mortgage calculator to provide an illustration of monthly repayment amounts for different terms and interest rates on a 12000000 mortgage. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. Use our mortgage calculator to see how much you may be able to borrow with a NatWest mortgage our mortgage rates and what your monthly mortgage payments could be in under 5.

Two-year 40 and 5-year fixed 28 mortgages are the most popular in the UK. Meanwhile the average APR on the 15-year fixed mortgage. Make sure to add taxes maintenance insurance and other costs.

Mortgage lenders in the UK. You could lose your home if you do not keep up payments on your mortgage. As a percentage of your income Some say that fixed payments mortgage repayments plus any other loan or hire purchase payments should be no more than 3040 of gross income.

If your interest rate is 25 percent higher at 525 percent your monthly payment becomes 55220 a difference of about 15 a month. If youre concerned about any of these talk to. Contact Us to Get Started.

Ad Purchase a Second Home or Investment Property in the US. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself. Current Mortgage Rates.

The average APR rose on a 30-year fixed mortgage today inching up to 604 from 599. How much are the total costs. Adding 5000 to your mortgage with an interest rate of 35 for 25 years 4375 interest.

According to MoneySuperMarket the average borrowing amount is 213000 right now. Mortgages are secured on your home. Contact Us to Get Started.

These are your monthly income usually salary and your. This calculator helps you work out how much you can afford to borrow. If you have a 200000 15-year loan at 5.

Generally lend between 3 to 45 times an individuals annual income. Your total interest on a 250000 mortgage On a 30-year mortgage with a 4 fixed interest rate youll pay 17967377 in interest over the life of your loan. Against this backdrop approximately 170 billion of investment-grade corporate bonds and 29 billion of speculative-grade corporate bonds issued by nonfinancial.

Ad Purchase a Second Home or Investment Property in the US. The amount you spend to repay credit and store cards catalogue purchases loans overdrafts maintenance and your pension. You dont need to tell us about general household spending.

What are the costs for 250000. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Yet borrowing 5000 at an interest rate of 3 over three years perhaps through a personal loan would cost you 23141 in interest payments Even borrowing 5000 at an.

When applying for a further advance on your mortgage your lender will conduct a. Think carefully before securing other debts against your home. If your mortgage is a repayment.

Loan Amount Interest Rate Years. Our affordability calculator can tell you how much you can potentially borrow from a mortgage lender. In some cases we could find lenders willing to go.

Specialty Mortgage Brokers for Florida Texas California.

Mississauga Second Mortgage Brokers Lenders Serving All Of Ontario

Mortgage Mayhem By Marc Rubinstein Net Interest

Mississauga Second Mortgage Brokers Lenders Serving All Of Ontario

Loan Modification Specialist How Not To Get Ripped Off Real Estate Investment Group Home Equity Property Management

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Tables To Calculate Loan Amortization Schedule Free Business Templates

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Mortgage Loans National Bank Mortgage Loans Mortgage Loan

Fed S Senior Loan Officer Survey Reflects More Normal Economy

Monthly Calendar Template Cute Planner Ideas Printable 2022 Calendar Diy Planner Notebook Layout In 2022 Monthly Calendar Template Calendar Template Planner Pages

Fed S Senior Loan Officer Survey Reflects More Normal Economy

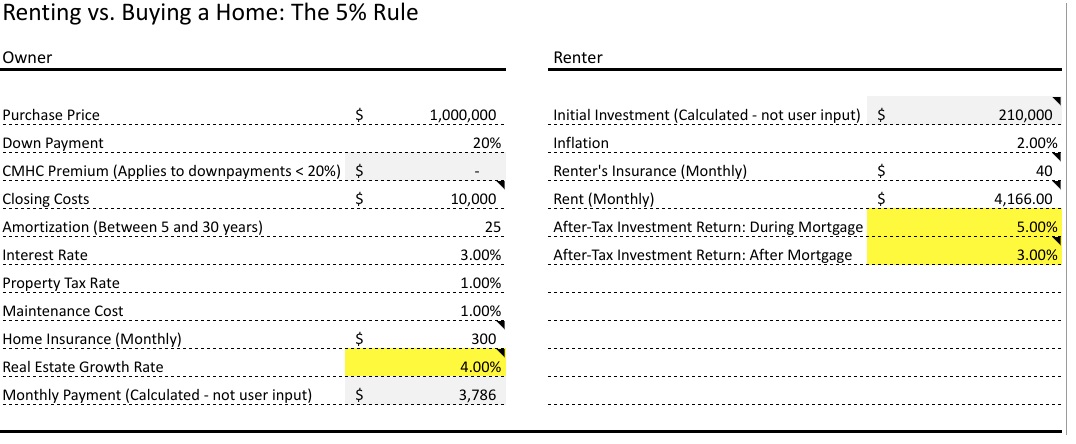

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

How Much Of Your Rental Income Can You Use To Get Approved For A Mortgage Loan Quora

10 High Paying Jobs That Don T Require A Degree High Paying Jobs Paying Jobs Tech Job

Mississauga Second Mortgage Brokers Lenders Serving All Of Ontario

Have You Refinanced Your House When You Buy A House You Get To Deduct The Poin Refinancing Mortgage Refinance Mortgage Refinancing Mortgage Mortgage Lenders

4 Tips For Choosing The Right Mortgage Lender Programmer Python Python Programming